On Jul 18, 2023 at 15:15:46 ET Unusually Large $5,416.00K Call Contracts Caterpillar (CAT) The purchase expires in 3 day(s) (July 21, 2023) at the $230.00 strike price. Fintel tracks all large options trades, and the premium on this trade was 14.13 sigmas above average, placing it in the 100.00th percentile of all recent large trades in CAT Options.

This trade was originally taken on Fintel’s real time. Flow of options Tool, where unusual options trades are highlighted.

What is the sentiment of the fund?

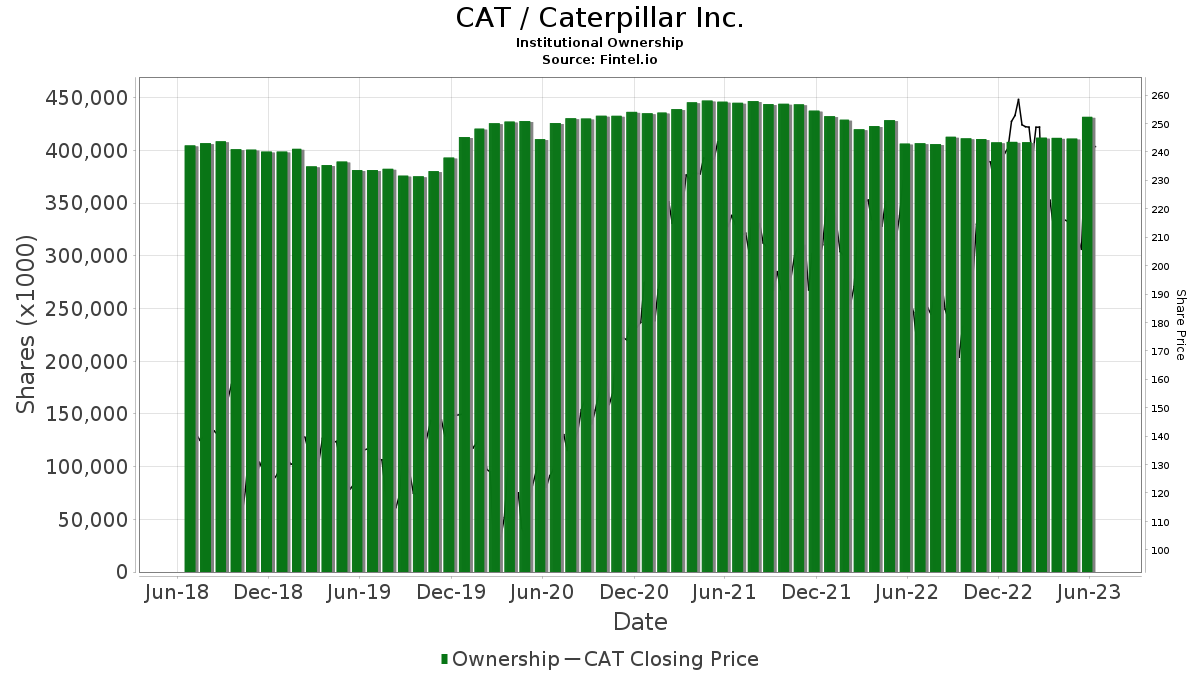

are there 3273 funds or institutions that report positions by Caterpillar. This is an increase of 55 owner(s) or 1.71% over the previous quarter. Average portfolio weight of all funds The allocation for CAT is 0.40%, an increase of 5.97%. Total shares held by institutions rose 4.94% to 432,031K shares over the past three months. of Call ratio The CAT is 1.29, indicating a bearish outlook.

Analyst price forecast suggests a 4.38% decline

From July 6, 2023, an average of one year Price target For Caterpillar it is 246.17. The forecasts range from a low of $176.75 to a high of $315.00. The average price target indicates a downside of 4.38% from its recent close of 257.46.

See ours Companies leaderboard Up with a bigger price target.

The projected annual revenue for Caterpillar is 62,487MM, an increase of 1.28%. The proposed annual non-GAAP EPS It is 15.19.

What are other shareholders doing?

Capital world investors Holds 28,780K shares representing 5.58% ownership of the company. In the preliminary filing, the company reported that it has 29,091 thousand shares Reduction From 1.08% of the company decreased The portfolio allocation in CAT stood at 8.37% in the last quarter.

Ofi Invest Asset Management Holds 28,287K shares representing 5.49% ownership of the company.

State Farm Mutual Automobile Insurance Holds 17,761K shares representing 3.45% ownership of the company. No change last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares Holds 15,986K shares representing 3.10% ownership of the company. Before filing, the company reported that it represented 15,820 thousand shares Increase From 1.04% of the company decreased The portfolio allocation in CAT was 10.87% in the last quarter.

VFINX – Vanguard 500 Index Fund Investors Shares Holds 12,143K shares representing 2.36% ownership of the company. Before filing, the company reported that it represents 12,030 thousand shares Increase From 0.93% of the company decreased The portfolio allocation in CAT increased by 10.58% in the last quarter.

Caterpillar background information

(This statement is provided by the company.)

Since 1925, Caterpillar Inc. It’s helping our customers build a better world – enabling sustainable growth and positive change on every continent. In the year With 2019 sales and revenue of $53.8 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Services offered throughout the product lifecycle, cutting-edge technology and decades of product knowledge distinguish Caterpillar, providing exceptional value to help our customers succeed. The company provides financial and related services primarily through three main segments – Construction Industries, Resource Industries and Energy & Transportation – and the Financial Products segment.

Key documents for this company:

This story appeared first Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.